Investment Philosophy

Evidence-Based, Low-Cost, Disciplined Implementation

Contrary to what the headlines often want you to believe, good investing is rarely exciting, and maintaining control is rarely easy! It requires discipline and the proper allocation, but when done well can be a critical factor in helping you reach your financial goals. While this style of investing may not be for everyone, it's focused on long-term drivers of risk-adjusted performance, minimizing or eliminating unnecessary risks and fees, avoiding emotional investing and is based on decades of research from Nobel-prize winning economists.

Here are some of the basic tenets of our investment philosophy:

1

Embrace Market Pricing

The market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers—and the real-time information they bring helps set prices.

2

Don’t Try to Outguess the Market

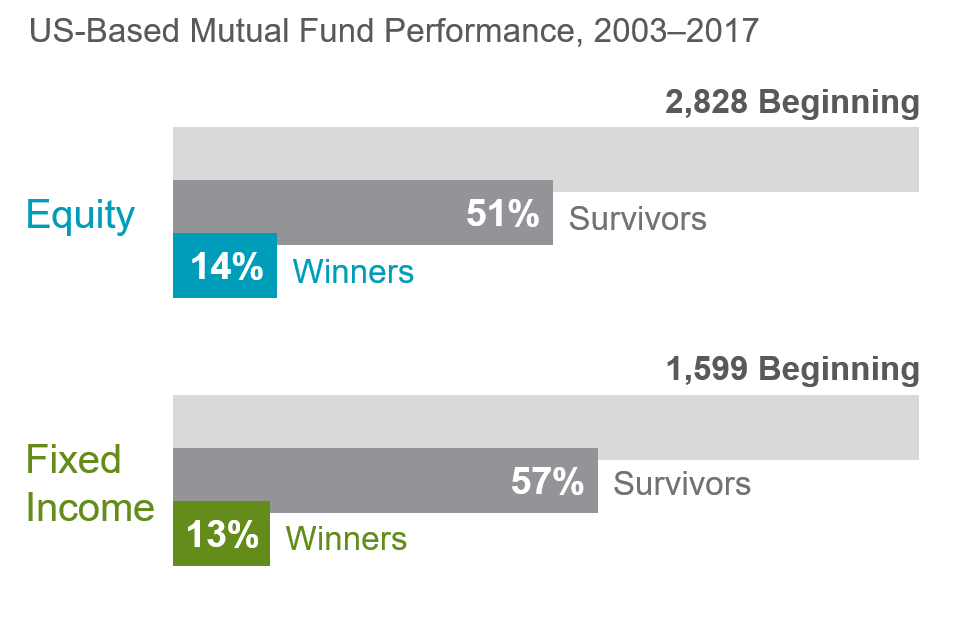

The market’s pricing power works against mutual fund managers who try to outperform through stock picking or market timing. As evidence, only 14% of US equity mutual funds and 13% of fixed income funds have survived and outperformed their benchmarks over the past 15 years.

3

Resist Chasing Past Performance

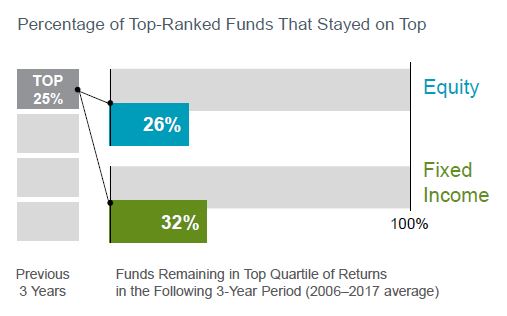

Some investors select mutual funds based on their past returns. Yet, past performance offers little insight into a fund’s future returns. For example, most funds in the top quartile (25%) of previous three-year returns did not maintain a top‐quartile ranking in the following three years.

4

Let the Markets Work for You

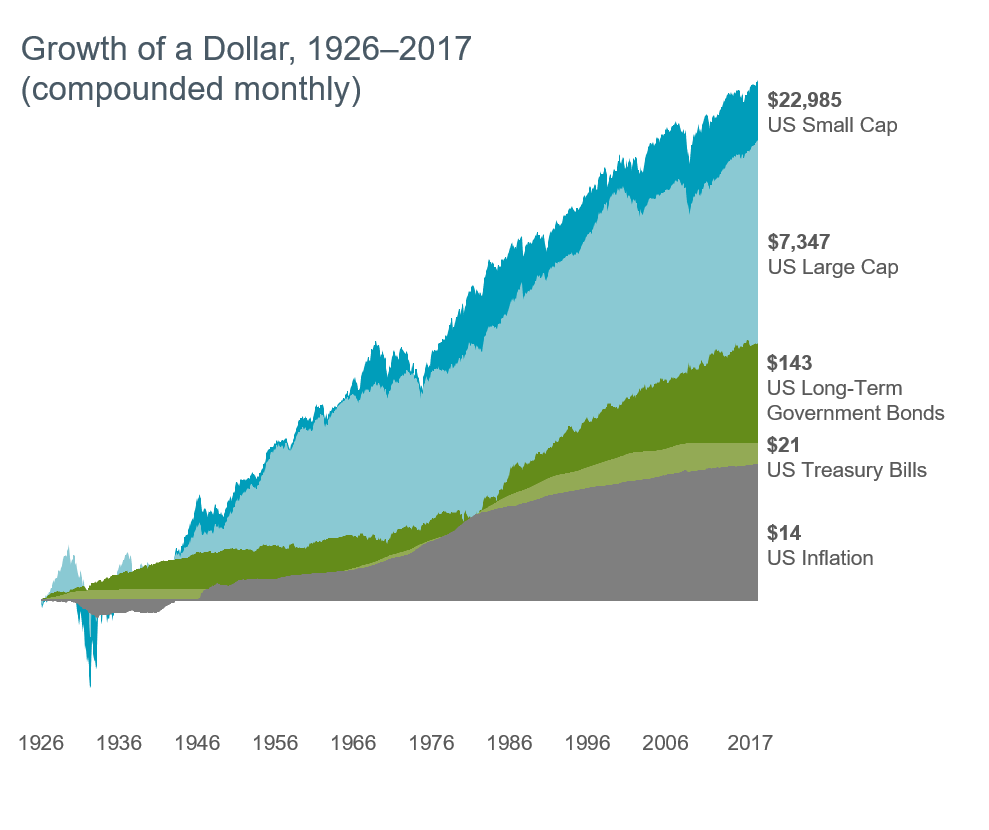

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

5

Consider the Drivers of Returns

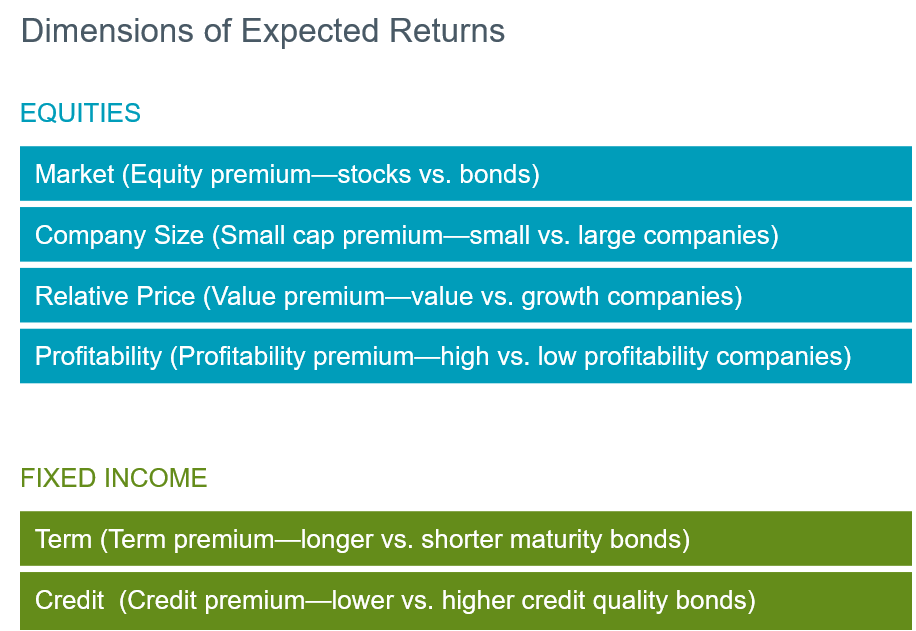

Academic research has identified these equity and fixed income dimensions, which point to differences in expected returns. Investors can pursue higher expected returns by structuring their portfolio around these dimensions.

6

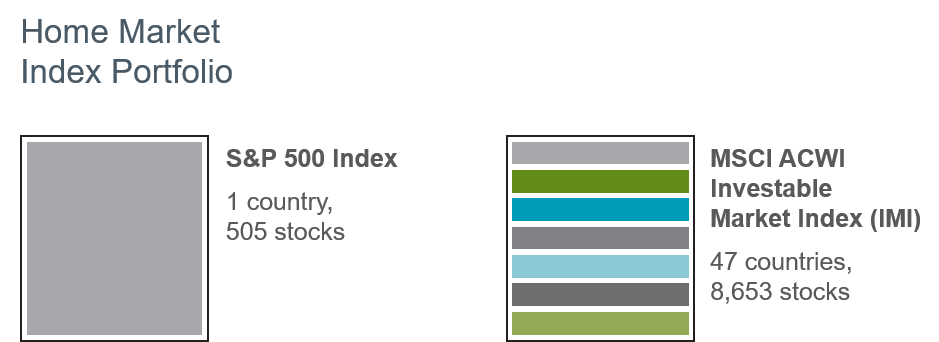

Practice Smart Diversification

Holding securities across many market segments can help manage overall risk. But diversifying within your home market may not be enough. Global diversification can broaden your investment universe.

7

Avoid Market Timing

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

8

Manage Your Emotions

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

9

Avoid the Headlines

Daily market news and commentary can challenge

your investment discipline. Some messages stir anxiety about the future while others tempt you to chase the latest investment fad. When headlines unsettle you, consider the source and maintain a long-term perspective.