Riding High… 2Q2019 Review

Spoiler alert: you probably shouldn’t. For the past 5 (or 500) years, nearly all prospective clients ask some variation of “is it a good/bad time to invest?” And while the investments have changed- furs, tulip bulbs, stocks, bonds, real estate, Bitcoin, etc, the short answer remains the same (excluding tulip bulbs- so far) that depends on your timeframe (Read my article on zooming out here) Keep reading for my longer answer or if you’re having trouble sleeping at night.

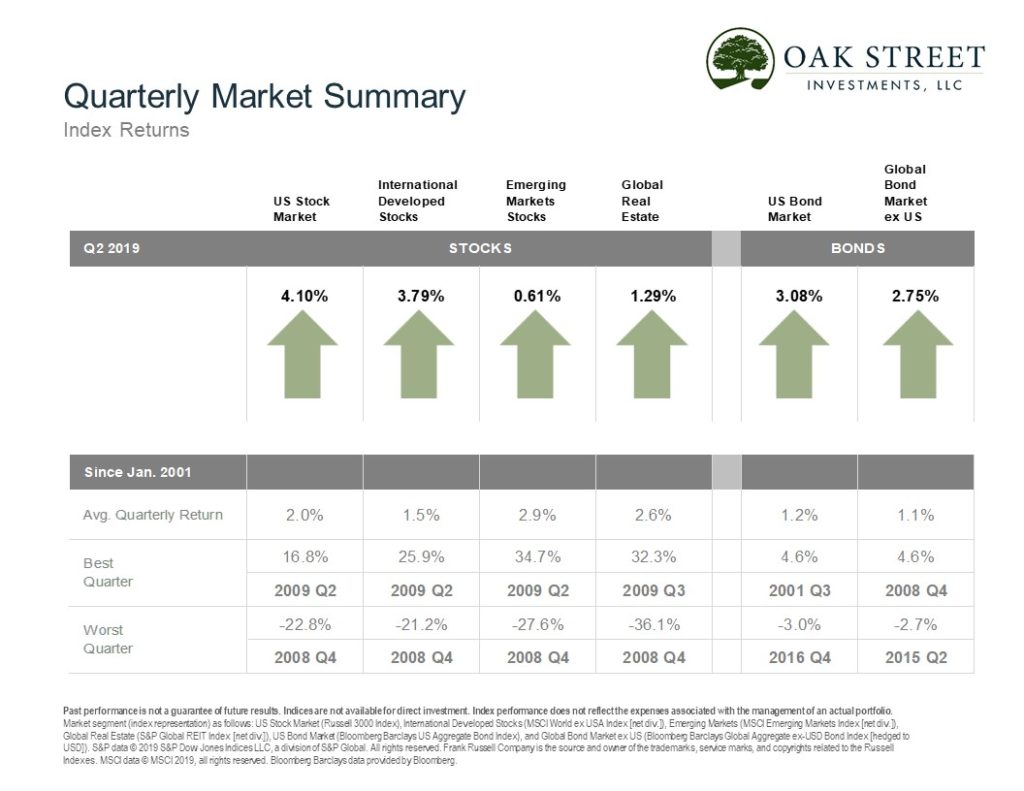

US markets as measured by the S&P500 are trading near all-time highs. And while the S&P500 is not a great proxy for a diversified portfolio of global stocks and bonds (like yours, right?), it’s still a good indicator that a meaningful portion of your portfolio should be up in value regardless of when you bought. Looking back over 10, 20 or 50 years of market performance- always a good idea for those with itchy market trigger fingers- two observations are clear: that over short periods of time (milliseconds to 7 or even 10 years) there were better and worse periods to be buyers; and that with longer investment timeframes much of this market turbulence simply becomes noise if you have the discipline to ride out the volatility. The best and worst times to “get in” to the market generally correspond to and negatively correlate with periods of market euphoria (worse times i.e. 2008, 2000, etc) and market capitulation (better times e.g., 2009, 2002, etc,). Yet even if you had timed the market exactly “wrong” and bought in April of 2000 after sitting on the sidelines for years watching cousin Vinnie making easy money in dot-com stocks, your portfolio would still be up roughly 185% or nearly 5.5% annualized with reinvested dividends! Sure, you would have watched your portfolio get cut in half…twice…but you’d still have nearly doubled your money over the past 20 years. Perhaps not great, but remember, we’re using hindsight to hand-pick one of the worst times in recent history to purchase stocks. Put differently, buying stocks at the “wrong” time has simply meant a longer waiting period to get back to where you started and growing your portfolio, sometimes waiting CLICK FOR THE FULL 2Q2019 REVIEW